Tracking Identity Theft

Life comes at you fast and is never dull.

After picking up our mail a few weeks ago, we found a letter addressed to Jake from the Montana Department of Labor and Industry. Opening it, we learned that Jake had filed an unemployment claim.

While we could make a crack about self-employment, Jake is certainly not unemployed, so we knew something was up.

After getting ahold of the Montana Department of Labor and Industry, Jake learned that his identity had been stolen and someone was using his personal information to file this claim.

And all of a sudden, we had a new use case for Cascadin.

Cascadin and tracking identity theft

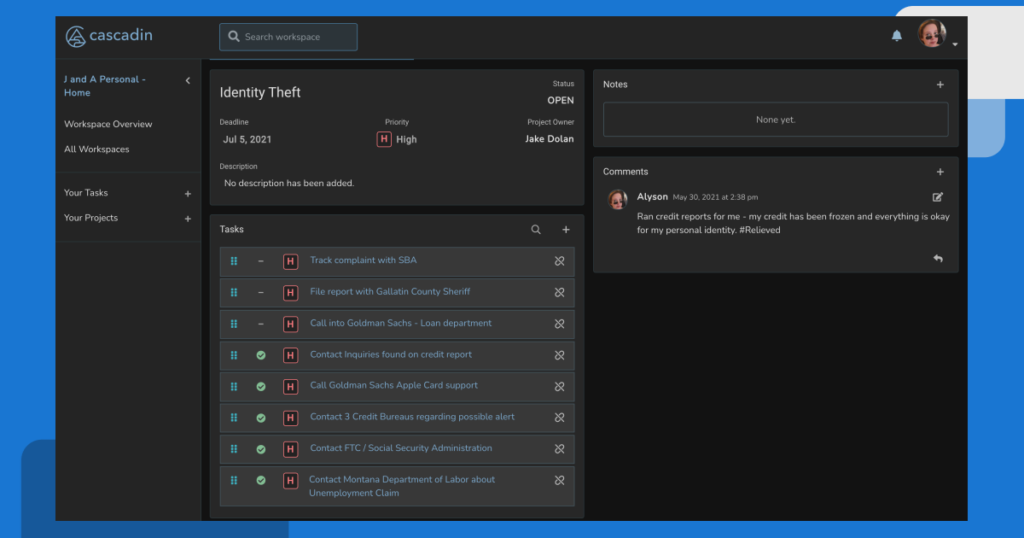

Neither of us has experienced identity theft before, but Jake knew that to tackle this, he needed to document a lot of his actions moving forward. From the moment he learned about this situation, he started using Cascadin to track and document his steps. Creating a Project, he shared it with me so that I would be able to also see where things were at, keeping lines of communication open and transparent between us.

Luckily, we believe we’ve caught it early enough that the damage done is minimal. Of course, that sense of security isn’t strong. Jake’s documentation of each step he’s taken will be invaluable in the future. He’s recorded the names of every person he’s spoken with and a summary of what he’s done with each institution. He can set up reminders to follow up on something 6 months from now, long after the sense of security has returned but the threat is still present.

This realization is why it’s so helpful to use a tool like Cascadin that gives you the ability to quickly and simply document your actions, recording them safely for future reference. Identity theft horror stories abound, and we could see issues months or years from now.

A rising number of identity theft

We aren’t the only recent victims of identity theft. In fact, in almost every conversation Jake has had with financial institutions, law enforcement, and others, there is an acknowledgment that identity theft is on the rise. With the government investment in small businesses, increased unemployment support, and more through COVID relief packages, there is an opportunity that nefarious individuals are taking advantage of.

“The expansion of eligibility for jobless benefits to self-employed individuals during the coronavirus pandemic has caused a 4,800 percent increase in unemployment fraud cases, according to an identity theft expert speaking Monday at a House Ways and Means Committee roundtable.”

– Jon Jackson, Newsweek, May 11, 2021

According to a recent report issued by Allstate Identity Protection (AIP), “unemployment fraud in 2020 increased by more than 17,000%. Tax fraud also increased last year, by 258% more than 2019. AIP has warned that both are likely to continue rising, with unemployment fraud cases expected to more than triple in 2021.” These numbers are astronomical and might make you a little concerned.

Reduce your risk

At a minimum, we encourage you to take some steps to make sure your identity and credit are okay.

Get your credit report from each of the three credit bureaus:

Set up an account with each credit bureau to make it easier to check every 2-3 months.

Sign up for fraud alerts from one or more of the credit bureaus:

Each credit bureau has paid subscriptions with more robust alerts and protections, but the free fraud alerts are a great place to start.

If you’re not planning on applying for a loan, mortgage, or other types of credit in the next year, you might want to consider freezing your credit. This will prevent anyone else from applying for credit under your name. You can unfreeze your credit when you’re ready to apply for something yourself.

These few simple steps will help you protect yourself and your identity. We know that there will always be people trying to exploit opportunities, but that doesn’t mean we can’t take steps to protect ourselves.

If you’ve experienced identity theft, what other steps do you recommend we take?

We’re the lucky ones. We caught it soon enough, it seems, that no credit was approved under the fraudulent claims. We’ll keep tracking this identity theft thanks to the simple documentation features that Cascadin provides. We really are the lucky ones.

Onward!

Additional Resources:

Alyson Roberts

Co-Founder & CEO

Known for organizing the dirty dishes before cleaning them, Alyson is learning how to do less, better and helping others do the same. She loves exploring beautiful lands near and far, trying new recipes, aspiring to be the next Star Baker, growing her garden, and avoiding board games at all cost.